Pkf Advisory Services Fundamentals Explained

Pkf Advisory Services Fundamentals Explained

Blog Article

Pkf Advisory Services Fundamentals Explained

Table of ContentsA Biased View of Pkf Advisory ServicesGetting My Pkf Advisory Services To WorkThe 15-Second Trick For Pkf Advisory ServicesPkf Advisory Services Can Be Fun For AnyonePkf Advisory Services Can Be Fun For EveryoneThe Ultimate Guide To Pkf Advisory ServicesPkf Advisory Services Things To Know Before You Get This

The solution to this question will inform you just how and when your economic consultant can meet you. Are they readily available evenings and weekends? Just how usually can they consult with you? Some monetary advisors may favor to have quarterly or month-to-month check-ins, and some might choose to fulfill on a case-by-case basis.Worth investing, growth investing, socially responsible investing (SRI), and basic analysis are a few of one of the most typical. Ask your economic expert which they favor and you'll have a better concept of how they'll manage your investments. Maintain in Mind: Your financial situation is special. That's worth repeating. You deserve more than a one-size-fits-all method to your financial future.

If you and your advisor are on the same page, you can proceed with confidence. To determine your all-in costs, you'll require to ask your financial consultant just how their charges are structured.

We'll state it once more since we believe it deserves repeating. Financial preparation is for every person. If you're simply starting, specific monetary products and financial investment possibilities might not make good sense right away. That's OK. A great economic advisor will fulfill you where you go to. You don't require to be a particular age or have a certain quantity of possessions to gain from financial preparation.

Pkf Advisory Services for Beginners

We 'd like to help. Send us a message, offer us a telephone call, or come see us to with Canvas.

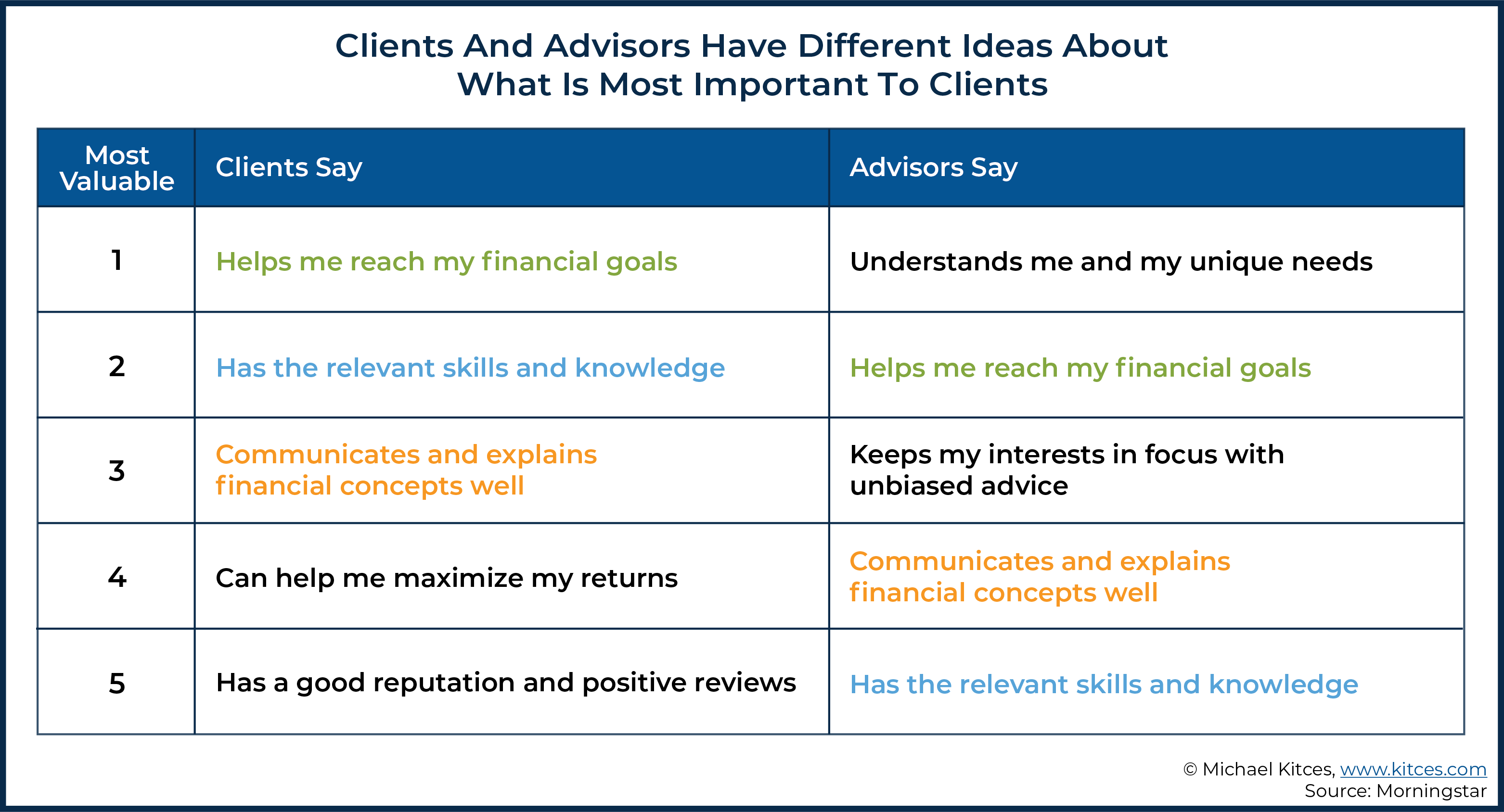

A client's count on the financial expert is as vital as monetary performance. Personal attention is vital. Clients need to know that the consultant is keeping an eye out for their monetary passions. Small things matter - PKF Advisory Services. An ignored e-mail or telephone call can break the relationship. A report by Lead highlights the significance of partnership administration in drawing in and keeping clients in a changing advising space.

The same record discovered that 94% of financiers were most likely to make a recommendation when they "very trusted" their advisor. Clients with high levels of trust were likewise greater than twice as likely to use a recommendation, contrasted to those that stated they only had a moderate quantity of rely on their consultants.

Facts About Pkf Advisory Services Uncovered

Vanguard found that clients were most likely to trust their consultants when they thought that their practical, emotional, and moral needs were being met. Specifically, clients were much more most likely to trust an expert that did what they claimed they were going to, acted in the customer's benefits, and made choices that permitted the customer to sleep well in the evening.

If your time is ideal invested in connection administration or prospecting versus back-end office jobs, as an example, he suggests outsourcing as much of that job as possible. Producing a service schedule can also be valuable, states Lanter. This suggests talking about just how often customers would love to fulfill and what topics they desire to cover each time you attach.

Not known Details About Pkf Advisory Services

Once they've chosen you, it's time to reach help them. Keep in mind, this is a two-way road. Some clients may feel you're not the very best advisor for them and vice versa. If your knowledge and client base are comprised mainly of professionals nearing retired life, you might refer the youngest prospects to somebody that focuses on their economic concerns.

Financial consultants have a tendency to specialize. They might be particularly proficient at taking care of the economic events of ladies, army professionals, extremely rich people, or educators. As a financial expert, you need to consider what kind of customer you intend to bring in and keep. Clients were more probable to trust an expert that did what they claimed they were going to, constantly acted in the customer's benefits, and chose that allowed the client to sleep well in the evening, according to a Vanguard research.

Get This Report on Pkf Advisory Services

Terry Vine/Getty Images; Picture by Austin Courreg/Bankrate When it pertains to handling your money, you do not want anyone Check Out Your URL messing it up which includes you. There might come a time where you need to call supports and employ a monetary consultant, especially when you're making large choices with your money.

This may be worth it to you if you have a complicated economic circumstance or you wish to be as hands-off as feasible. That yearly charge can chip away at your returns as your cash grows. If you are looking for a person to help you navigate a specific life event or establish a general technique for your financial resources, you might intend to take into consideration a financial consultant with a different settlement framework, like a hourly rate or a fixed fee.

Once they've chosen you, it's time to reach work for them. Remember, this is a two-way road. Some customers might feel you're not the very best expert for them and vice versa. If your knowledge and customer base are composed mainly of professionals nearing retired life, you may refer the youngest prospects to a person that concentrates on their financial priorities.

Top Guidelines Of Pkf Advisory Services

Financial consultants have a tendency to specialize. As an economic expert, you should consider what kind of customer you desire to attract and keep.

Terry Vine/Getty Images; Image by Austin Courreg/Bankrate When it comes to handling your money, you don't want anybody messing it up and that includes you. There could come a time where you need to contact reinforcements and work with an economic advisor, particularly when you're making huge choices with your cash.

Pkf Advisory Services Fundamentals Explained

This may deserve it to you if you have a complicated financial situation or you desire to be as hands-off as possible. That annual cost can chip away at your returns as your cash grows - PKF Advisory Services. If you are looking for someone to aid you browse a specific life event or establish a general approach for your financial resources, you might wish to think about a financial consultant with a different repayment framework, like a hourly price or a taken care of cost

Report this page